Highlights

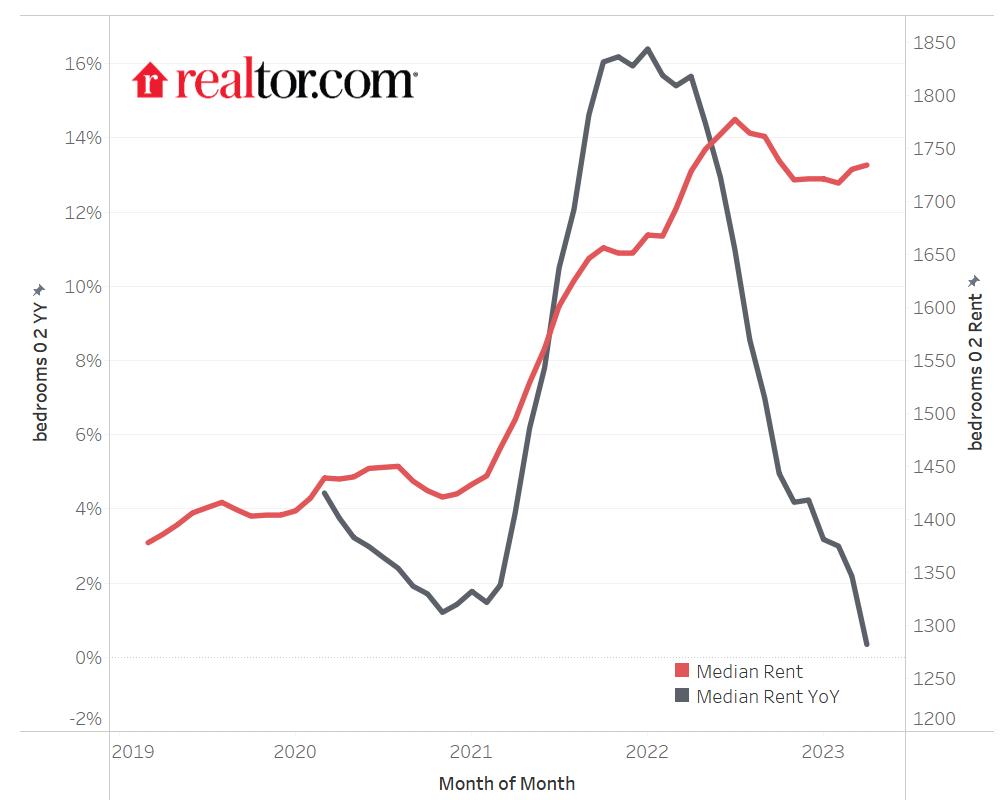

- April 2023 marks the fifteenth month of slowing rent growth, and ninth month in a row with a single-digit rate of increase for 0-2 bedroom properties (0.3% Y/Y), the lowest rate since onset of the pandemic.

- The median asking rent in the 50 largest metros increased to $1,734, up by $4 from last month and down $43 from last year’s peak.

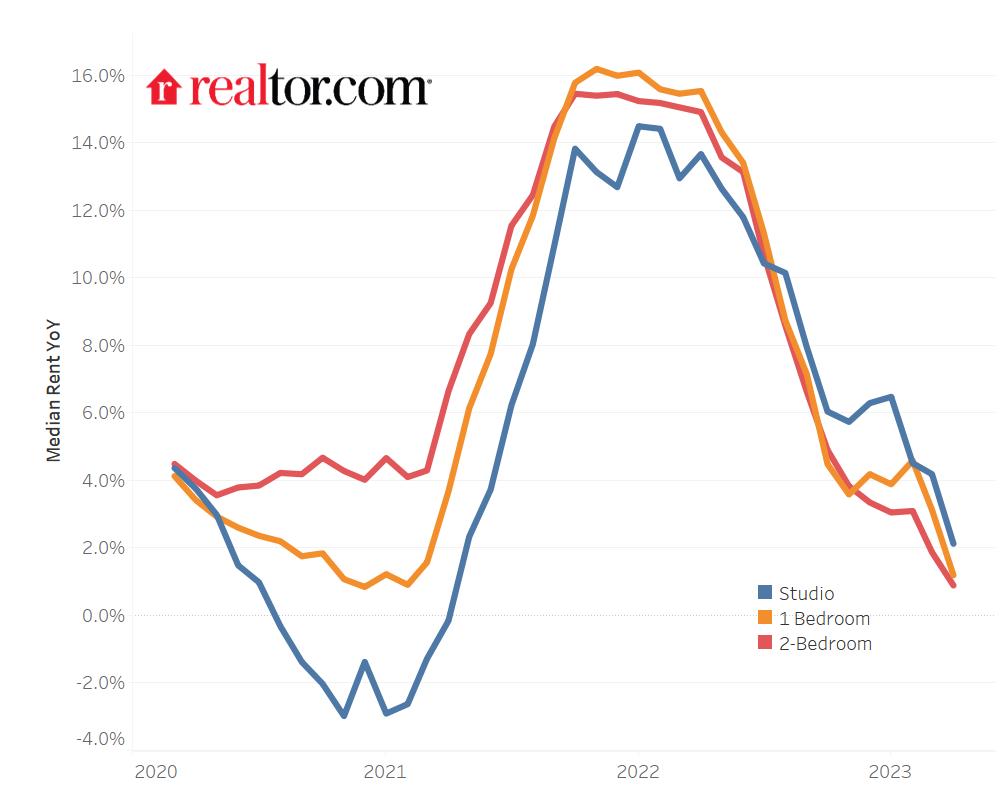

- Rent has been growing faster in smaller units. Rent by size: Studio: $1,444, up 2.1% ($30) year-over-year; 1-bed: $1,618, up 1.2% ($19) year-over-year; 2-bed: $1,936, up 0.9% ($17) year-over-year.

- Rents in the Midwest continue to increase faster (4.9% Y/Y), while rents in the West (-2.6% Y/Y) and Sunbelt market (-2.5%) were lower than a year ago.

- As rent increases were more pronounced for new renters, many existing tenants chose to avoid higher costs by renewing their leases, resulting in lower renter mobility and a stickier CPI shelter index.

In April 2023, the U.S. rental market experienced single-digit growth for the ninth month in a row after fifteen months of slowing from a high of 16.4% growth in January 2022. Median rent across the top 50 metros was up just 0.3% year-over-year for 0-2 bedroom properties, the lowest growth rate since the onset of the pandemic. The median asking rent was $1,734, up by $4 from last month and down by $43 from the peak but still $348 (25.1%) higher than the same time in 2019 (pre-pandemic).

An important factor contributing to this rapid slowing is the record-high new construction of multi-family homes, resulting in an increase of rental inventory. Furthermore, the rental vacancy rate has reached its highest point since the first quarter of 2021, standing at 6.4% in the first quarter of 2023. As more new rental properties are added to the market, we anticipate that the vacancy rate will continue to inch back toward 7.2%, which was the 2013-2019 norm, improving conditions for renter households. Despite a slowdown in annual rent growth, concerns about affordability are still on the rise. Nearly 90% of respondents of the most recent Fannie Mae’s National Housing Survey believed home rental prices will not improve in the next 12 months, reflecting a more gloomy outlook compared to the end of 2022.1

Figure 1: Year-over-Year Rent Trend

Smaller Units See Faster Growth

In April 2023, the rent growth of two bedroom units increased just 0.9%, marking the slowest growth rate since the onset of the pandemic. Nevertheless, April is the fourth straight month that we saw positive rent gains in two-bedroom units on a monthly basis, a possible return to typical trends that have been absent amid the upheaval of the pandemic and subsequent recovery. The median rent for two bedrooms was $1,936 nationally, $17 (0.9%) higher than the same time last year but still $32 lower than the July 2022 peak. Even though rent for larger units had the smallest gains relative to last year, larger unit rents had the highest growth rate over the past four years, up by $430 (28.6%).

Rent growth for one-bedroom units went up and down on a year-over-year basis in recent months, sliding to 1.2% in April 2023. The median rent was $1,618, at the same level as last month but still $34 less than the July 2022 peak. Nevertheless, the median one-bedroom rent is still up by $19 (1.2%) compared to the previous year and $327 (25.3%) higher since April 2019.

In April, rent growth in studios dipped to 2.1%. As renters sought affordability, studio rents grew faster than larger 2-bedroom units over the last nine months. The median rent of studios was $1,444, down by $1 compared to last month. Nevertheless, it is up by $30 (2.1%) year-over-year and $243 (20.2%) higher than four years ago–a significant jump that is only slightly smaller than that seen in larger units.

Figure 2: National Rent Trend by Unit Size

Table 1: National Rents by Unit Size

| Unit Size | Median Rent | Rent YoY | Rent Change – 4 years |

| Overall | $1,734 | 0.3% | 25.1% |

| Studio | $1,444 | 2.1% | 20.2% |

| 1-bed | $1,618 | 1.2% | 25.3% |

| 2-bed | $1,936 | 0.9% | 28.6% |

Rents in Western Coastal Metros Cooling Faster Than Their Northeast Peers

The recent wave of job cuts in the tech industry has likely impacted the rental demand in large metros on the west coast. In April 2023, the median rent in the West was 2.6% lower than a year ago. Specifically, rents in Seattle, WA (-0.2%) saw the first year-over-year declines in nearly 2 years, and rents in San Diego, CA (-1.0%) saw the first decline in over 2.5 years. Although San Jose, CA (3.2%) appears to be an outlier in March, its growth rate was only one sixth of what it was a year ago (19%), and it is more likely to continue to trend downwards in the coming months. In contrast, rents in populous northeastern metros such as New York, NY (8.0%), Boston, MA (4.2%), and Washington D.C (4.9%) continued to experience faster growth.

The latest rental vacancy rate aligns findings in the rental trends. In the first quarter of 2023, the rental vacancy rate in Western markets remained the same as it was 12 months ago (4.6%). However, the rate in the Northeast decreased from 6.5% to 4.4% between the first quarters of 2022 and 2023, indicating a more competitive market condition in the Northeast.

Rents in Sun Belt Markets Declined

In April 2023, the median asking-rent for 0-2 bedroom rental properties across Sun Belt metros was 2.5% lower than one year ago. The top 5 metros experiencing the most significant year-over-year rent declines are all clustered in the Sun Belt regions: Riverside, CA (-10.9%), Las Vegas, NV (-5.7%), Phoenix, AZ (-5.2%), Austin, TX (-4.8%), and Tampa, FL (-4.1%).

In 2023Q1, the rental vacancy rate in the sun belt markets increased to 7.1%, 1 percentage point higher than 12 months ago and 0.7 percentage points higher than the national average, suggesting the rental market has been softening.

Rents in Midwest Markets Continue to See Faster Growth

On the flip side, rents in Midwest metros continued to see faster rent growth. In April 2023, the median rent growth rate was 4.9%. As the Midwest markets tend to have greater affordability, the stronger growth in these markets likely results from this benefit even as it may reduce existing affordability. Among the top 10 metros experiencing the fastest year-over-year growth, six of them are located in the Midwest: Cincinnati, OH (9.9%), Detroit, MI (8.9%), Columbus, OH (8.4%), Indianapolis, IN (8.1%), Milwaukee, WI (6.8%), and St. Louis, MO (5.7%). The other four metros are New York, NY (8.0%), Pittsburgh, PA (7.1%), Oklahoma City, OK (7.0%) and Louisville/Jefferson, KY-IN (6.0%). In addition, in 2023Q1, the rental vacancy rate in the Midwest was 6.6%, 0.8 percentage points higher than 12 months ago and 0.2 percentage points higher than the national average. Specifically, the rate was increased most in Minneapolis, MN, rising from 5.3% in 2022Q1 to 10.1% in 2023Q1.

Faster Growth in Asking Rents and Decreasing Renter Mobility Make the Shelter Price Index Stickier

As the largest regular expense for most households, shelter costs are a subject of significant interest to consumers and a significant component of the Consumer Price Index (CPI) data. Between April 2022 to April 2023, the U.S. city average for shelter increased by 8.1 percent, down from 8.2 percent in March, and the first slowing since March 2021. Both its primary components – owners’ equivalent rent of residences and rent of primary residence – experienced a year-over-year increase of 8.1 and 8.8 percent. The shelter index increased 0.4 percent on a monthly basis (seasonally adjusted), the smallest month-over-month change since February 2022.

While the CPI shelter index is how we measure the extent to which rent costs are impacting consumer budgets and inflation pressure, it typically lags behind market-based rent measures. For example, although the year-over-year growth for median asking-rents listed on Realtor.com declined to its lowest point in November 2020, the CPI shelter index dropped to its lowest point four months later.

Figure 3: Year-over-Year Grown in Median Asking Rents and the CPI Shelter Index

An important reason for this lag is because the rent growth we reported captures only asking-rents for advertised rentals, which are presumably advertised due to tenant turnover, whereas the CPI shelter index is survey-based and includes rents paid by both new and existing tenants. Existing tenants typically pay the same monthly rents for the entire lease period, and also tend to have smaller renewal increases, resulting in a “sticky” price. As a result, changes in shelter prices may take longer to show up in the CPI shelter index compared to other data sources.

In fact, even though the year-over-year growth of Realtor.com’s median-asking rent reached its peak in January 2022 and started receding the next month, the CPI shelter index only started easing in the April 2023 data, suggesting a peak in March 2023. The reason behind this disparity is complex but several factors could contribute to it. In early 2021, the rental market started to recover with skyrocketing median-asking rent growth. A recent study by Avail, a Realtor.com company , found that moving to a new residence is costing renters more than renewing.2 On top of that, a recent rental study conducted by the BLS revealed that the difference in rent costs between new and existing renters has been expanding. In the first half of 2021, the average percentage change in rent was 12.2% for new tenants and 3.5% for same tenants but with a lease renewal in the last 6 months. However, the difference between the two groups increased to 8.7 percentage points in the first half of 2022.3

Figure 4: Percentage Change in Rent by Type of Tenant in the Last Six Months

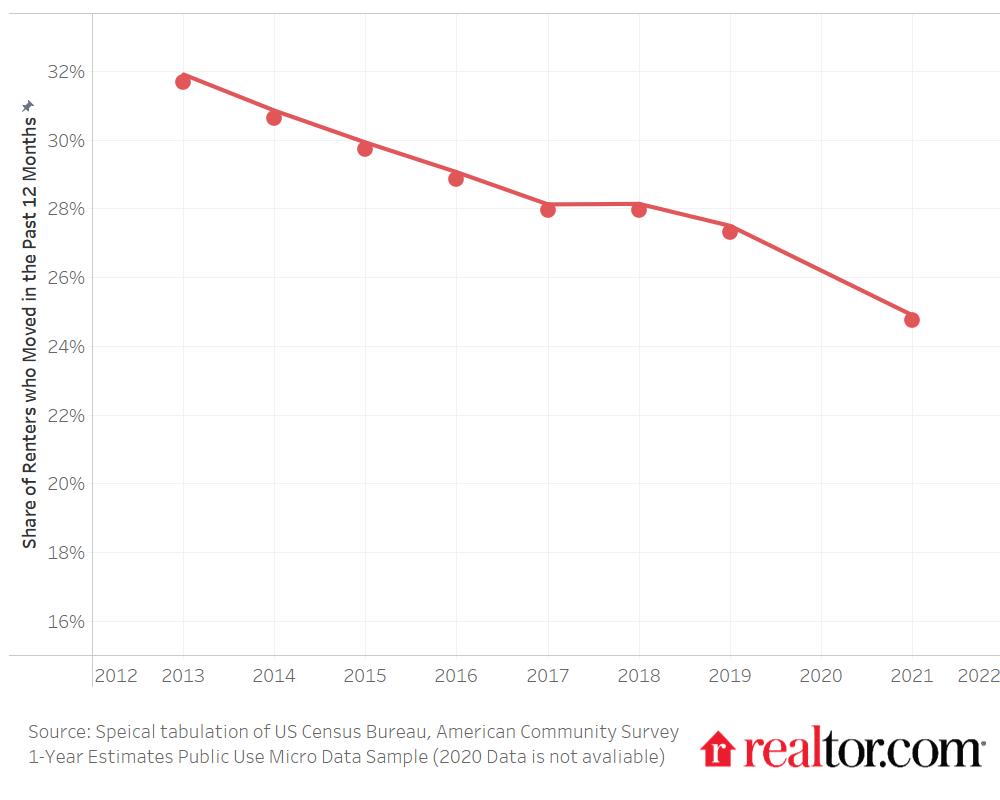

As a result, many renters may prefer to remain in their current residences to avoid the higher cost of new rentals. In fact, the share of renters who moved in the past 12 months declined to its lowest rate in 2021 (Figure 5), suggesting a record-high lease renewal rate. Since more tenants chose to secure lower rents by renewing leases than before, a larger proportion of the growth in market rents has not yet been captured in the shelter index, amplifying the lags between the CPI shelter index and making it stickier.

Shelter costs continue to be the largest contributor to inflation. In other words, as long as the shelter index remains elevated, it will continue to provide upward pressure to the overall inflation. A recent Federal Reserve Bank of Boston study shows that even under a condition of slow market-rent growth moving forward, shelter is likely to dampen any improvement in the overall inflation until later this year, but its impact will diminish considerably in 2024.

Figure 5: Renter Mobility Rates (Age 18+)

Appendix: Rental Data – 50 Largest Metropolitan Areas – April 2023

Methodology

Rental data as of April for studio, 1-bedroom, or 2-bedroom units advertised as for-rent on Realtor.com®. Rental units include apartments as well as private rentals (condos, townhomes, single-family homes). We use rental sources that reliably report data each month within the top 50 largest metropolitan areas. Realtor.com® began publishing regular monthly rental trends reports in October 2020 with data history stretching back to March 2019.

With the release of its April rent report, Realtor.com® incorporated a new and improved methodology for capturing and reporting more comprehensive rental listing trends and metrics. The new methodology is expected to yield a cleaner, more representative and more consistent measurement of rental listings and trends at both the national and local level. The methodology has been adjusted to better represent the true cost of primary housing for renters. Most areas across the country will see minor changes with a smaller handful of areas seeing larger updates. As a result of these changes, the rental data released since April 2023 will not be directly comparable with previous releases and Realtor.com® economics blog posts. However, future data releases, including historical data, will consistently apply the new methodology.

Footnotes

- In Dec. 2022, 86% of renters believed the rental prices will not improve in the next 12 months. In April 2023, 66%, 12%, and 21% of respondents believed that home rental prices will go up, go down, or stay the same in the next 12 months. About 1% of the respondents answered with ‘don’t know’.

- According to the survey, more than half of surveyed renters who have been in their current rental for 12 to 24 months have seen rent increase by an average of 13%. Meanwhile, those seeking to move to a new rental within the past year are faced with a more drastic rent hike of nearly 27%.

- In the first half of 2022, the average percentage change in rent was 12.2 percent for new tenants and 3.5 percent for same tenants but with a lease renewal in the last 6 months.